Hey there small business owner, are you struggling to figure out how much to charge for your services? It’s always a challenge for every SMB owner. The simplest approach is the traditional cost-based pricing method that simply covers your costs of production, but that’s not the best option for businesses that want to grow.

If you really want to increase profit and stand out from your competitors, it’s time to start pricing based on perceived value. Value-based pricing is a smart pricing strategy that considers the psychological aspects of how much customers perceive your goods or services are worth, so you can maximize profits.

What is value-based pricing?

Value-based pricing is a strategy that sets prices based on a customer’s willingness to pay for a product or service, rather than the costs of production. It uses your target market’s perceived value of what you’re selling to determine price points, rather than competitors’ pricing or cost-plus pricing methods.

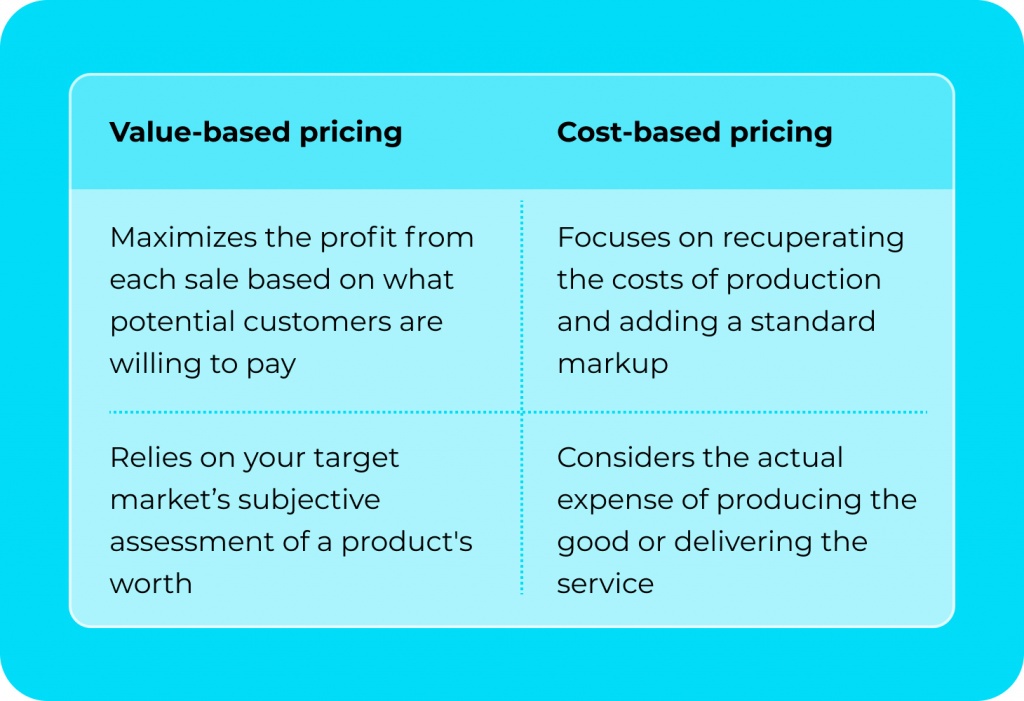

How value-based pricing differs from cost-based pricing

With value-based pricing, you set a price that maximizes the profit from each sale based on what potential customers are willing to pay. In contrast, cost-based pricing focuses on recuperating the costs of production and adding a standard markup. Value-based pricing relies on your target market’s subjective assessment of a product’s worth, while cost-based pricing considers the actual expense of producing the good or delivering the service.

Why use value-based pricing?

Value-based pricing allows you to capture more of the perceived value of your offerings. By pricing according to what your customers are willing to pay rather than your costs, you can increase profit margins and gain a competitive advantage.

Some of the benefits of value-based pricing include:

- Higher price points. You can charge premium prices for a product or service because customers consider that they are receiving more value.

- Increased profitability. Value-based pricing aims to maximize the profit from each sale.

- Competitive positioning. Value-based pricing allows you to differentiate your business from competitors and avoid competing solely based on price.

- Targeted offerings. Value-based pricing encourages businesses to develop product and service offerings tailored to specific customer segments, which can strengthen your connection with your target market.

- Stronger brand loyalty. Value-based pricing requires you to demonstrate your product or service’s worth, which drives stronger brand loyalty.

How value-based pricing works

Because value-based pricing is based on your customers’ perceived value, your goal is to set a price that allows you to increase profit margins while remaining in line with your customers’ perceived value.

Using value-based pricing, you can discover the range of prices your customers are willing to pay, and then set prices at the higher end of that range. This pricing strategy allows you to increase profits without losing customers to lower-priced competitors.

When to Use Value-Based Pricing

Value-based pricing works well for small service businesses, innovative products, and premium or exclusive goods and services. It may not be ideal if you’re trying to achieve high-volume sales or gain significant market share. In those cases, pricing strategies like Market Penetration Pricing or Price Skimming may be more effective.

Value-based pricing can be highly profitable when you have:

- A unique product or service with few direct competitors

- A loyal customer base that highly values your offering

- Flexibility to adjust pricing based on changes in perceived value over time

How to determine what customers are willing to pay

To succeed with value-based pricing, you need a clear understanding of what your target market and customers are willing to pay for your product. Several factors influence a customer’s willingness to pay, including:

- Your brand credibility and reputation. Established businesses with a proven track record of success and customer satisfaction can typically charge higher prices.

- The experience you provide. An exceptional, personalized experience from start to finish often increases the perceived value. Customers are willing to pay more for a product or service that makes them feel good.

- Exclusivity. When a product or service is scarce or unique in some way, customers will usually pay a premium. They want what not everyone else has.

- The solution provided by your products or services. Customers will pay more for something that efficiently resolves their pain points or discomfort, or which helps them to save or make money.

Anything you can do to increase any or all of these factors will help you with your value-based pricing strategy. Of course, you also need to work out how much your customers are willing to pay. Here are some ways to identify your pricing sweet spot.

- Test different price points. Try offering your service at different price levels and see how customers respond. Their reaction will show you the ideal pricing level.

- Survey your target market. Asking potential customers directly what they would be willing to pay for your services can provide useful insight.

- Analyze your competitors’ pricing. See what other businesses that provide a similar service are charging. You may be able to match or even exceed their prices if you can demonstrate greater value.

While it may require some testing and adjusting to get value-based pricing right, it can lead to significantly higher profit margins than cost-based pricing alone.

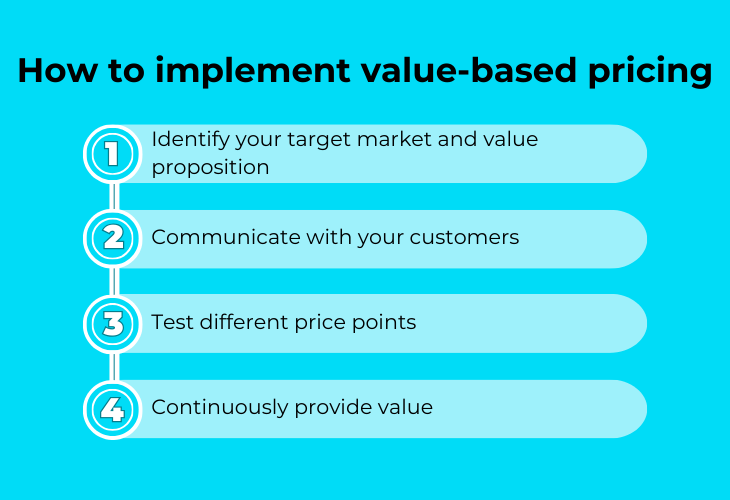

How to implement a value-based pricing strategy for your business

Using value-based pricing can be more complex than simple cost-based pricing, but it can be worth it for the extra profits and growth. Here’s an overview of the entire process of implementing a value-based pricing strategy.

Identify your target market and value proposition

The first step is always to define your target market and assess what your product or service is worth to them. Evaluate your competitors’ pricing and how your offerings differ.

What extra value do you provide to customers that they would be willing to pay a higher price for? These insights will help you set prices at the upper end of what your customers perceive as the product’s value.

Communicate with your customers

Next, survey your target market to gauge how much they would pay for your product or service. Ask open-ended questions to determine their willingness to pay for specific features and benefits. This data can give you an understanding of acceptable price points and the features that drive value for customers. You may find that different customer segments have different price thresholds, pointing to opportunities for differential pricing.

Remember that you also need to communicate the value of your products or services, so as to justify the price you’re charging. Use marketing strategies to educate potential customers about the benefits and impact of your offering.

Test different price points

Then, set your price based on perceived value. Start testing prices at the higher end of your customers’ willingness to pay, because you can always lower prices, but increasing them risks alienating your customer base. Monitor how response rates and sales volumes change at different price points, and make incremental adjustments until you optimize both revenue and profit margins.

Consider offering tiered pricing at different price points based on the value delivered at each level. This way you can reach customers with varying willingness to pay. You may also use psychological pricing, like charm pricing ($49 vs $50), to make the price seem more attractive.

Continuously provide value

Finally, you need to consistently deliver on the promised value and benefits at each price point. Value-based pricing only works if you follow through with high quality and service. Continuously improve your offering to maintain its value and justify premium pricing. Stay up to date with market changes and make adjustments to your pricing strategy as needed to keep up with your customers’ changing perceptions.

Value-based pricing could be the strategy you’ve been looking for

Value-based pricing allows you to set prices primarily based on the perceived value of your goods or services to customers. By determining what your target market is willing to pay and the value they gain from your offerings, you can implement a pricing strategy to increase profits, build a loyal customer base, and establish a strong brand identity. Though it may require an initial investment in marketing and product development, value-based pricing is a pricing strategy that can set your business up for long term success.