As a small business owner, you know the struggles of having to wait weeks or months to get paid after completing work for a customer. You still have bills to pay and payroll to meet while you’re waiting for that payment to arrive.

That’s where invoice factoring comes in. Invoice factoring can be a lifeline for small businesses by turning your outstanding invoices into immediate cash. Within a few business days, an invoice factoring company can buy your unpaid invoices and provide you with up to 90% of their value. Once your customer pays, you get the remaining amount minus a small factoring fee.

This improved cash flow can make the difference between struggling to pay your own bills, and actually growing your business.

What is invoice factoring?

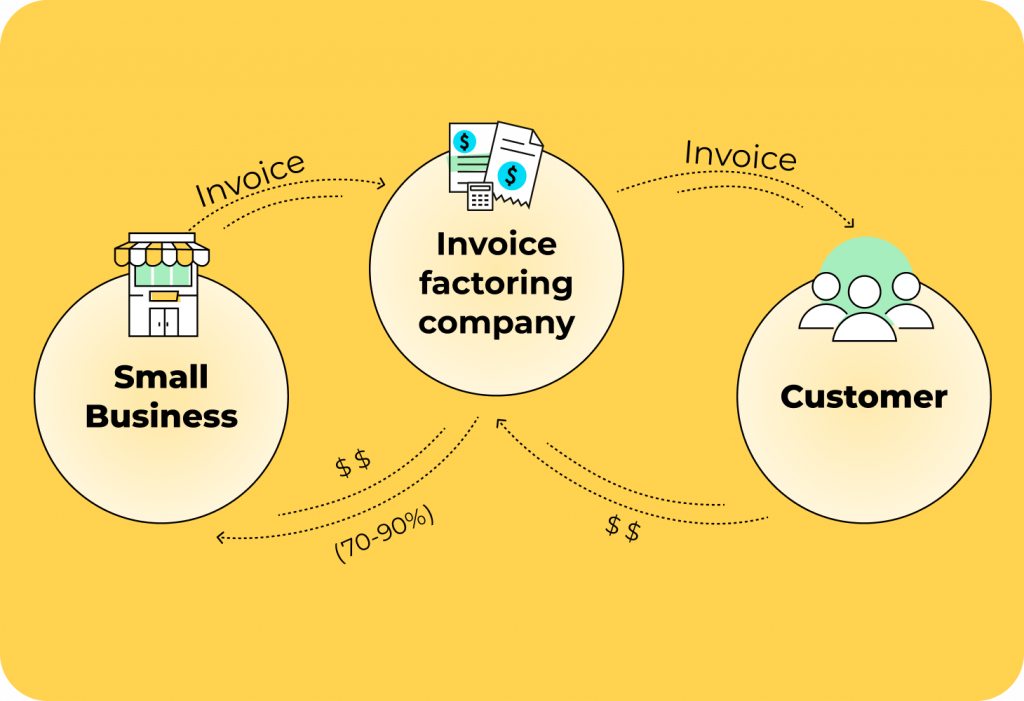

Invoice factoring, also known as accounts receivable financing, involves selling your outstanding invoices to a third party, called a factoring company, in exchange for most of the invoice amount upfront. The factoring company then collects the full payment from your customer.

If unpaid invoices and long payment terms are hurting your business, invoice factoring could be an ideal solution. It lets you get back to running your company instead of chasing down payments.

Some invoice factoring companies operate on the basis of recourse factoring. This means that if a customer never pays, you agree to pay back the advance you received. With non-recourse factoring, the factoring company assumes the risk of non-payment. Invoice factoring companies that use recourse factoring are a lot more likely to accept businesses with poor credit or who have customers with poor credit.

How does invoice factoring work?

With invoice factoring, you sell your unpaid invoices to an invoice factoring company at a discount. They advance you most of the invoice amount, often 70-90%, within 2-3 business days.

Then, when your customer pays the invoice, the factoring company collects the full amount and keeps the remaining percentage as their factoring fee. This fee depends on the creditworthiness of your customers and the time until payment is due, but 1-5% per month is standard.

For example:

- You issue an invoice for $10,000 with 90-day terms

- The factoring company pays you $9,000 upfront and gets in touch with the customer to collect the full $10,000

- When your customer pays up, the factoring company keeps the remaining $1,000 as their fee

This way, you’ve received several thousand dollars that you need right now to pay your electricity bill, instead of having to wait 3 months and find some way to scrape together enough to keep the lights on.

The benefits of invoice factoring for small businesses

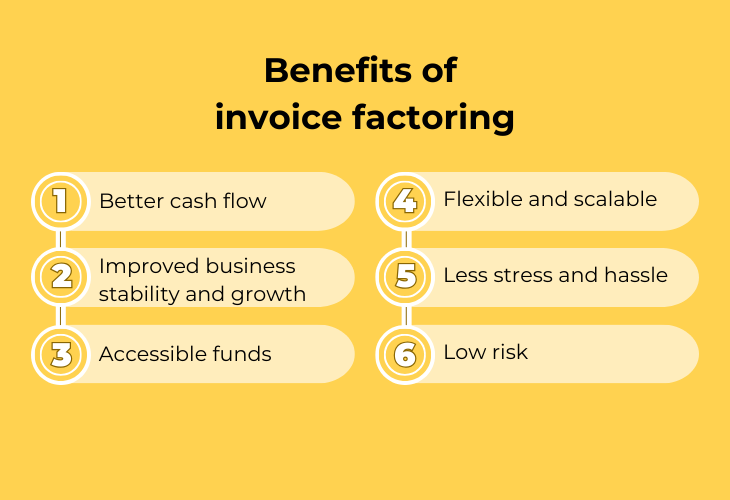

Invoice factoring brings a great number of benefits for small businesses that have long payment cycles. Here are some of the advantages you’ll appreciate when you use invoice factoring.

Better cash flow

Invoice factoring allows small service businesses to unlock cash tied up in outstanding customer invoices. Rather than waiting 30 days or more to get paid, you can get access to most of the money owed to you within a few business days. This improved cash flow means you have money to pay employees and suppliers on time.

Improved business stability and growth

You can use the money from factored invoices to fund operations, instead of tying it up in accounts receivable. This means less need for loans or lines of credit, which can affect business stability. Access to funds when you need them most also empowers you to take advantage of growth opportunities as soon as they appear.

Accessible funds

Unlike a bank loan or line of credit, invoice factoring relies on your customers’ ability to pay. It doesn’t require you to have a high credit score, or call for collateral that could be unaffordable or unrealistic. The factoring company’s decision is based primarily on the creditworthiness of your customers.

Flexible and scalable

Invoice factoring is a flexible solution for accessing working capital, because you can choose to sell as many or as few invoices as you need to. There’s no obligation to sell more than necessary. Some factoring companies have dashboards so you can keep tabs on when customers pay and adjust your invoice factoring decisions month by month

Less stress and hassle

Using invoice factoring means that the factoring company has all the work of tracking down customers and reminding them to pay. What’s more, some factoring companies offer invoice generation and management services. They handle invoicing, collections, and payment processing so you can focus on your business.

Low risk

When you use invoice factoring with non-recourse factoring, the factoring company assumes all the risk of nonpayment. They thoroughly review your customers’ ability to pay before approving invoices. If a customer defaults, it’s on them.

The disadvantages of invoice factoring

It’s important to remember that there are some drawbacks to using invoice factoring. The factoring company does charge a factoring fee which is usually higher than the interest you’d pay on a bank loan. However, for many small business owners the improved cash flow and reduced time spent on collecting payments and managing invoices is worth the cost.

Invoice factoring vs. invoice financing: what’s the difference?

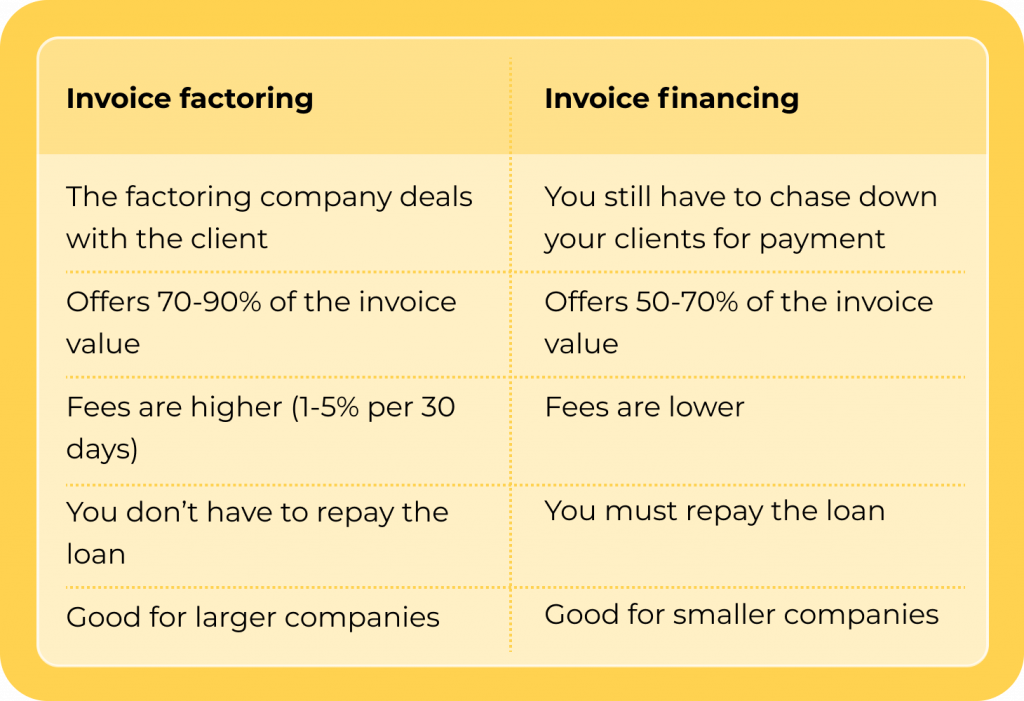

While invoice factoring involves selling your accounts receivables, invoice financing is a type of loan that allows you to borrow against your outstanding invoices. Here are the main differences between the two financing methods:

- With factoring, the factoring company is responsible for collecting on your invoices. With financing, you still have to chase down payment from customers.

- Factoring usually provides more capital, around 70-90% of the invoice value, while financing typically offers less, only around 50-70%.

- Factoring fees are higher, often 1-5% of the invoice value per 30 days. Financing fees are typically lower, similar to the interest rates on a loan.

- With non-recourse invoice factoring, there is nothing for you to repay. With invoice financing, you need to repay the loan. If you use recourse invoice factoring, there’s a small risk that you might have to repay the advance amount.

- Invoice factoring is often better for larger corporations, whereas invoice financing may suit smaller companies.

Is invoice factoring right for your small business?

In an ideal world, you won’t need invoice factoring, or any kind of loan, line of credit, or capital advance. But in the real world, having customers pay only 30, 60, or 90 days after invoicing can put a major strain on your cash flow, and make it difficult for you to pay your own bills.

In these situations, invoice factoring allows you to unlock the potential of your outstanding invoices and get paid in just a few business days. Invoice factoring can be a good option if:

- You have B2B customers with longer payment terms (e.g. net 30 or net 90 days) who you trust to pay on time

- You need quick access to cash to fund growth or cover expenses

- You want to improve your cash flow without taking on debt

- You spend a lot of time on invoice management and collection efforts

It’s true that the fees charged by invoice factoring companies may seem high compared to a bank loan. However, for many small businesses the benefits of faster payment and improved cash flow far outweigh the costs.

Invoice factoring could save your business

If collecting from customers and waiting to get paid is slowing down your business, invoice factoring could be the solution you need to unlock your cash flow. It provides quick access to cash and improved cash flow, eliminating the need to wait weeks or months for customers to pay. With faster access to money and less risk of non-payment, you can increase profits, seize new opportunities, and achieve sustainable business growth.