Every small business owner wants to get paid faster. The solution can be as simple as improving the way you write and send your invoices. Little things like a clear invoice template and subject line can make a big difference in those invoicing processes.

Read on to learn tips for small businesses on how to create an invoice that gets you paid faster.

How to create an invoice for your small business

As a small business owner, creating and sending professional invoices is key to getting paid on time. The good news is, with the right invoicing processes and software in place, sending an invoice that gets paid faster is totally doable.

Before you start, make sure you have all the necessary details for your invoice to hand. This includes:

- Your business’ name, address, phone number, and email

- An invoice number

- The date

- Your client’s information

- A description of the product or service

- Payment terms

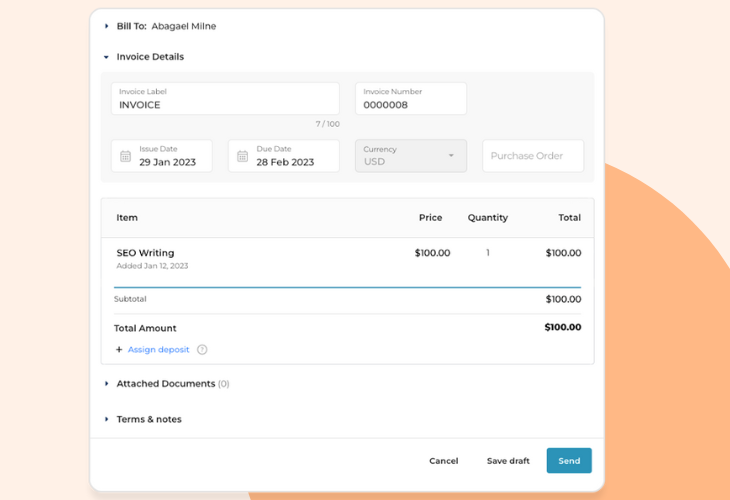

Some free invoicing software, like vcita, helps you generate a professional invoice template with all these details.

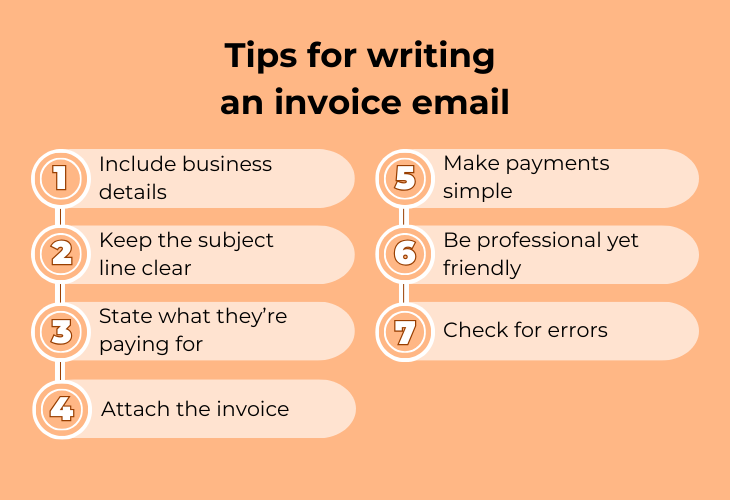

Tips for writing an invoice email that gets paid faster

To get your invoices paid promptly, you need to make the entire process as easy and clear as possible for your clients. Here are some tips for creating and sending an invoice email that gets results:

Include your business details

Have your business name, address, phone number and email at the top of the email. Also include an invoice number for reference. This makes you look more professional and gives the necessary details for payment.

Keep the subject line clear

Something like “Invoice for November Website Design Services – Invoice #1234” is perfect. Avoid writing a subject line that’s too short or vague.

Clearly state what they’re paying for

In the body of the email, politely and professionally state that the attached invoice is for the agreed upon work. Be concise yet descriptive. For example, “Please see the attached invoice for 10 hours of consulting work completed in January. According to our agreement, payment is due within 15 days of receiving this invoice.”

Attach the full invoice

The email is a courtesy, so you still need to attach an invoice including all the relevant details like items, quantities, rates, totals, payment terms, etc. Make it easy to read by using an invoice template.

Make paying simple

Explain the payment methods you accept, like checks, credit cards, or online payments through a service like PayPal or Stripe. The easier you make it to pay, the faster you’ll get paid. Using online invoicing and payment tools allows your clients to view and pay the invoice directly online using a credit card, which can help speed up payments.

Be professional but friendly.

Strike a pleasant and courteous tone in your email to build goodwill with your clients. But keep the email concise – you want them focused on paying the invoice!

Check for errors

Double check that all the information in your email and attached invoice is correct before hitting send. Little mistakes can cause big delays. Most importantly, make sure that you’ve attached the correct invoice file!

Choosing the best online invoicing software for small businesses

Choosing user-friendly invoicing software can streamline your invoicing processes and help ensure you get paid faster. Here are some tips for selecting the best online invoicing tool for your small business:

Find a solution with an intuitive interface

The software should make it easy to create an invoice, double check the details, and send it to your customers. Look for a simple interface with features like pre-built invoice templates, the ability to save customer details, and options to accept online payments.

Seek software that supports multiple payment methods

Choose software that allows your customers to pay by credit card, ACH transfer, or wire transfer. This makes it more convenient for them to pay you, which can help speed up payments.

Find tools to track invoice status

Look for software with the functionality to monitor invoice status and show you at a glance if an invoice has been viewed, paid or is past due. Some options offer automated payment reminders to help ensure no invoice slips through the cracks.

Consider your needs

For some small businesses, free or low-cost software with basic invoicing features will work great. If you need estimates, time tracking, expense reporting or other advanced tools, look for software with more robust options. Think about how your needs may change and grow over time.

With easy-to-use invoicing software in place, you’ll spend less time managing invoices and more time growing your business.

Setting payment terms on your invoice

The payment terms you include in your invoice are crucial for helping you get paid on time. They tell the client when payment is expected and how they can make that payment, so you need to be very clear in specifying your payment terms.

The most common terms are:

- Net 15 – Payment is due within 15 days of the invoice date. This is a typical timeframe for small businesses.

- Net 30 – Payment is due within 30 days. This may work better for larger clients or long-term relationships.

- Due on Receipt – Payment is expected as soon as the client receives the invoice. Only use this for high-priority or rush jobs.

To set payment terms on your invoice:

- Select your standard payment terms based on your business and client needs. For most small businesses, Net 15 or Net 30 are good options.

- Include the terms prominently on your invoice template. Place them near the top, along with your invoice number, date, and other key details. For example, “Payment Terms: Net 30 days”.

- State the terms clearly in the subject line and body of the email when you send the invoice. For example, “Invoice #1234 – Payment Due in 30 Days”. This reinforces the urgency and time sensitivity.

Back up your payment terms by following up with the client if payment is not received on time. Send a friendly payment reminder 3-5 days after the due date. Be professional but firm, restating your payment terms and the amount owed. You may need to charge late fees for chronically late clients. But use your best judgment, as this could damage the relationship. It may be better to renegotiate longer payment terms to avoid future issues.

Double check your invoice email before you send it

Once you’ve created your invoice, double check everything carefully before sending it to your client. Little invoicing mistakes can reflect poorly on your business and delay payment. Here are the most common errors that you’ll need to look for:

- Invoice number. This links the invoice to your records and helps avoid confusion if any questions come up.

- All the details about the product or service provided, including dates, amounts, descriptions, etc. This verifies you are charging the agreed upon payment terms.

- The client’s address, phone number and email. Having the right contact information is key to getting paid faster.

- The subject line and body of the email. The subject should clearly state it’s an invoice. The email should be polite but professional.

Using invoicing software like vcita can help minimize errors. The invoice templates ensure every invoice is consistent, and the system pulls details from your CRM to help reduce the risk of mistakes. The software will even double check the details for you.

Once everything looks correct, you’re ready to send that invoice. For the best results, consider offering multiple payment options like credit card, ACH or wire transfer in addition to checks. The easier you make it for clients to pay, the faster you’ll get paid.

Getting paid faster begins with better invoicing

Following these tips will help you create and send professional invoices that get paid faster. With the right tools and processes in place, invoicing for your small business services can be quick and painless, helping ensure that you get paid faster and your cash flow remains in good shape. Small improvements to your invoicing can make a big difference in getting paid faster, giving you more time and money to grow your small business.